Pet Insurance

Extensive wallet-friendly cover for your fur baby

Your fur baby is more than just a pet – they’re a cherished member of your family. And you want to give them the best care possible. That’s where our extensive-cover pet insurance with wallet-friendly options comes in.

We believe that every pet deserves top-quality care, without the need for a high price tag. That’s why we offer extensive pet insurance cover wallet-friendly options, that won’t break the bank.

Save up to 67% on your monthly premium with our high excess options

Pet insurance can be a big expense, that is why we offer higher excess options to help manage your premium whilst still providing extensive coverage for your furry friend.

With our high annual excess options, you'll pay a higher amount out of pocket when you file a claim, but you'll enjoy lower monthly premiums.

With our pet insurance plans, you have the freedom to choose an annual limit, benefit percentage, and annual excess to suit your budget.

*Saving is based on the difference between a $0 and $1,000 excess for a 3yr old male Cavoodle in Brisbane.

Tailor your cover

Annual limit

$10,000 $15,000, and $25,000

Benefit percentage

80%, 85%, and 90%

Annual excess

$0, $250, $500, $750, and $1000

Manage your premium without sacrificing cover.

Extensive cover without confusing opt-ins

At ExtrasJar, we believe that every pet deserves the best possible care. That's why we've designed our pet insurance with input from vets to provide extensive coverage. We want your furry friend to get the treatment they need and deserve.*

Other Pet Policies*

*ExtrasJar Pet Insurance is subject to exclusions, such as Pre-existing Conditions. Please see our Product Disclosure Statement (PDS) for more details. Comparison is based on a sample of in-market pet insurance policies (June 2023).

What’s the ExtrasJar difference?

At ExtrasJar, we’re different. We listened to pet owners who wanted more flexibility, clarity and control. We heard the horror stories of sub-limits, hidden costs, and emergency vet bills. So we took matters into our own paws.

Take control of your cover

Choose an annual excess that works for your budget and lifestyle with the option to select up to $1,000. And for even more peace of mind, select an annual limit of up to $25,000.

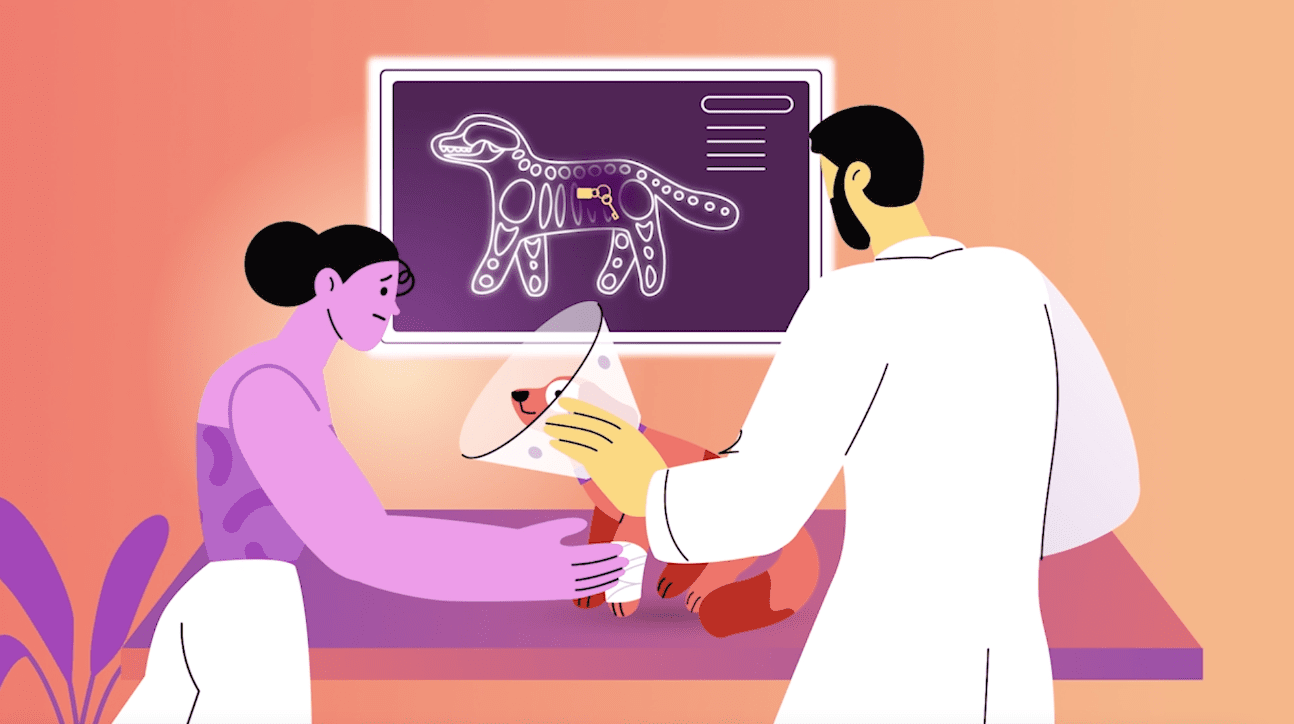

Peace of Mind for You and Your Pet

Say goodbye to sub-limits and hidden costs. With ExtrasJar Pet Insurance, you can claim up to your annual limit with confidence, regardless of treatment or condition. Plus, enjoy extra benefits included as standard, like coverage for dental illness, behavioural problems and specialised therapies.

Stay on Top of Your Pet's Health with ExtrasJar

Pair your pet insurance with a pet extras plan to build funds for services like grooming and vaccines. And, with 24/7 pet health hotline, there’s always a helping hand for you and your pet.

Invest in Your Pet's Health and Happiness with ExtrasJar Pet Extras

Want to give your pet the best possible care? Pair your pet insurance with ExtrasJar Pet Extras. Our pet extras plan allows you to save for services not covered by insurance, such as pet grooming, prescription food, and vaccines. Your savings are invested in the ExtrasJar Fund, making investing hassle-free. Plus, you can access your investments anytime to pay for pet extras with your pet extras Mastercard®.

Don’t let your pet miss out on the care they deserve. Find out more about ExtrasJar Pet Extras today.

Get the low-down

Your one stop shop for insurance and investment news, announcements and insights.

Reece Frazier

Reece Frazier

As Seen In

Unsure of anything?

Wherever possible, we try to make pet coverage easy for you. Whether it’s getting a quote or checking out the options, we’re here to make your ExtrasJar experience a good one.

Top 3 Frequently Asked Questions

ExtrasJar Pet Insurance is available to your companion cats and dogs that reside with you in Australia. We do not cover any other type of pets.

Our Policy has been designed for companion pets and therefore it is not possible to purchase cover for all cats and dogs.

Banned breeds

Certain breeds are considered dangerous and/or are banned in Australia. It is not possible to purchase cover for a dangerous or banned breed. If Your Pet’s breed is categorised as dangerous and/or banned in Australia after purchase or renewal of Your Policy, then Your Pet will no longer be eligible for this Policy and We will send You notice of non-renewal prior to the expiry of Your current Period of Insurance.

Work or sporting activities

Cats and dogs participating in commercial or sporting activity such as breeding or obstetrics, working, fighting, racing, personal protection, gun sports, law enforcement or guarding are not eligible for cover.

Note that it is possible to purchase cover for pets who participate in or are show dogs/cats, search and rescue dogs, guide dogs, assistance dogs or customs sniffer dogs.

Once you have insurance there is no age limit, this is called Lifetime Cover. There are minimum and maximum ages for starting insurance.

Minimum and maximum age of Pets on entry:

When purchasing a new Policy:

1. the minimum age for entry for a Pet is 6 weeks old; and

2. the maximum age for entry is 8 years and 364 days old.

Exclusion Periods apply to certain benefits available under the Policy. Cover is only available after the Exclusion Period has elapsed.

a. Accidental Injury (except Specified Conditions) 1 day

b. Illness (except Specified Conditions) 14 days

c. Optional Dental Illness 14 days – pets under 1 year old or

6 months – pets 1 year old or over

d. Optional Behavioural Problems 6 months

e. Specified Conditions 6 months

You may ask us to waive the Exclusion Period for some or all the Specified Conditions, and other Conditions (e.g. Dental Illness). When you take out a policy, we will provide an Application Form to apply for a reduction of Exclusion Period(s) for You and Your vet to complete.

Specified Conditions include cruciate ligament damage, intervertebral disc disease, hip dysplasia, patella luxation, elbow dysplasia, osteochondritis dissecans (OCD), cherry eye, entropion, ectropion, and Brachycephalic Obstructive Airway Syndrome (BOAS) and Lumps. Lumps are not considered a Specified Condition if Your Pet was under one (1) year old on the First Date of Cover or when Your cover increased.