Industry report outlines a roadmap for HSAs

The Australian healthcare system is facing an affordability crisis, with increasing gaps and exclusions in private health insurance causing financial strain and barriers to essential care access.

In response, the Australian government has initiated discussions on healthcare reform, aiming to improve access, affordability, and overall care quality. However, Health Savings Accounts (HSAs) have not been considered in current reform efforts, despite their potential to reduce out-of-pocket costs, enhance healthcare affordability, improve access to care, and alleviate cost concerns.

Reform is urgently needed, and HSAs could be a successful third pillar supporting the long-term sustainability of Australia’s healthcare system. ExtrasJar, which launched an HSA product in Australia in August 2022, has produced a comprehensive report outlining why reform is necessary and providing a roadmap for successful HSA implementation.

The report produced by ExtrasJar, titled “Health Savings Accounts – A third pillar to support the long-term sustainability of healthcare in Australia,” includes an open letter to Mark Butler, the Minister for Health and Aged Care, urging for policy reform to include HSAs. It outlines an efficient approach to operationalising, incentivising, and administering HSAs, utilising existing financial services infrastructure and the tax system to minimise implementation costs and facilitate effective change.

You can read the full report here.

Reform must include HSAs

The unresolved challenges with Medicare and the Private Health Insurance (PHI) industry, coupled with the cost of health care in the family budget, continues to keep reform at the forefront of people’s minds. The focus of health care policy reform to support the long-term sustainability of care has become a central component for the Australian Government and Australians alike.

In October 2019, the Australian Government established a steering group to provide independent expert advice to guide and assist in the development of a 10-year plan [1] for primary health care. The quadruple aim of the plan was to improve people’s experience of care, enhance the health of populations, improve the cost-efficiency of the health care system, and enhance the work-life balance of health care providers.

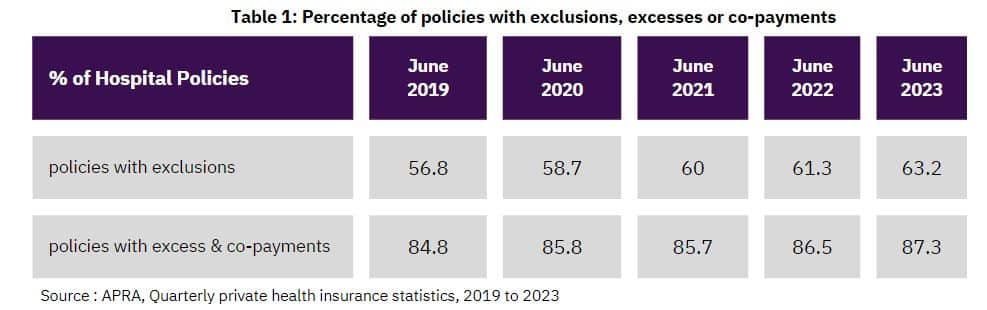

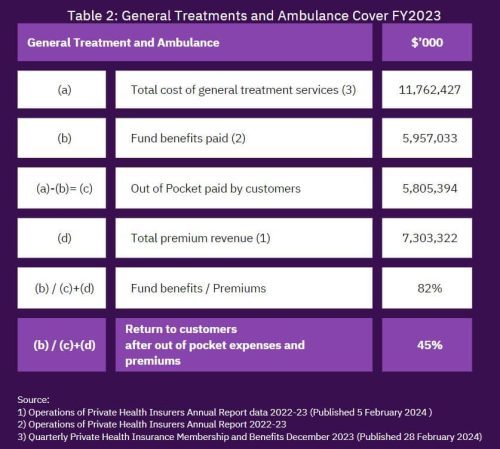

Surprisingly, the 10-year plan made no reference to HSAs as a pillar to support reform. The introduction of HSAs into Australia can assist the Government in achieving its main objectives, such as managing health and wellbeing in the community and embracing new technology and methods. With PHI in an affordability spiral, characterised by an increasing number of exclusions, co-payments, excesses, and out-of-pocket expenses, now is the time for reform to include HSAs. The efficiency of products such as general treatments cover should be challenged, and HSAs can supplement the current system and act as a third pillar to ensuring value for money and reducing the fear of health care costs.

An unhealthy status quo

The current design and approach to funding the Australian healthcare system are creating barriers for consumers to seek health services appropriate for their condition. Prompt access to private health services and preventative care is essential for good health and helps alleviate pressure from the public healthcare system. Unfortunately, access has been stifled by an affordability crisis, with an increasing trend in gaps, exclusions, and the fear of out-of-pocket expenses embedded in the design of PHI. HSAs can be a useful mechanism to support the system and provide more peace of mind to Australians.

The statistics are concerning, and there is a long list of sources showing the same trend. In a survey conducted by National Seniors of Australians over 50, respondents were most likely to forego mental health care due to cost, such as appointments with counsellors or psychologists (26%), as well as any kind of dental care (checkup 20%, treatment 24%) [2]. Moreover, the Australian Bureau of Statistics reported in its patient survey that 16.4% of Australians delayed or did not access dental care due to cost [2a].

The 2022 Vision Index found that while three in four Australians value vision as their most important sense, eye health issues have increased, causing concern for Optometry Australia. Despite this rise in issues, many Australians have never seen an optometrist (13%) or had an eye examination within the last two years (26%) [2b].

The Centre for International Economics, in its report “Saving for One’s Care” (SFOC) prepared for the Australian Dental Association, highlighted some of the negative impacts of not having timely access to healthcare. Regarding dental care, the SFOC report emphasised that delays in accessing preventative treatments like check-ups, or early intervention treatments such as fillings, are known to be associated with poorer long-term oral health outcomes. These delays often necessitate costly, complex, and uncomfortable procedures such as root canal or complete tooth removal [3].

The SFOC report suggests that poor oral health has ramifications for overall health, wellbeing, and quality of life. People with dental disease may suffer from pain, infection, and tooth loss, leading to difficulty eating, swallowing, and speaking, with flow-on effects for self-esteem [4].

Furthermore, tooth count is correlated with the probability of death from cardiovascular disease. People with less than 10 teeth are seven times more likely to die of coronary disease than someone with at least 25 teeth [5]. The SFOC report also emphasised that people who have 19 teeth or fewer and suffer from difficulty eating are 1.85 times more likely to die from respiratory disease compared with people who have at least 20 teeth [6]. The SFOC highlighted that the probability of death from cardiorenal mortality is three times higher in diabetics who have severe periodontitis compared to those without. Without timely access to preventative care, particularly for diabetics, it is a matter of life or death [7].

The Productivity Commission warned that health spending by all Australian governments, ‘could almost double from around 6 per cent of GDP currently to about 10 per cent by 2044–45’[8]. Without a reformative agenda, barriers to entry will continue accelerating the affordability crisis..

A crisis: Over 3 million may ditch their cover

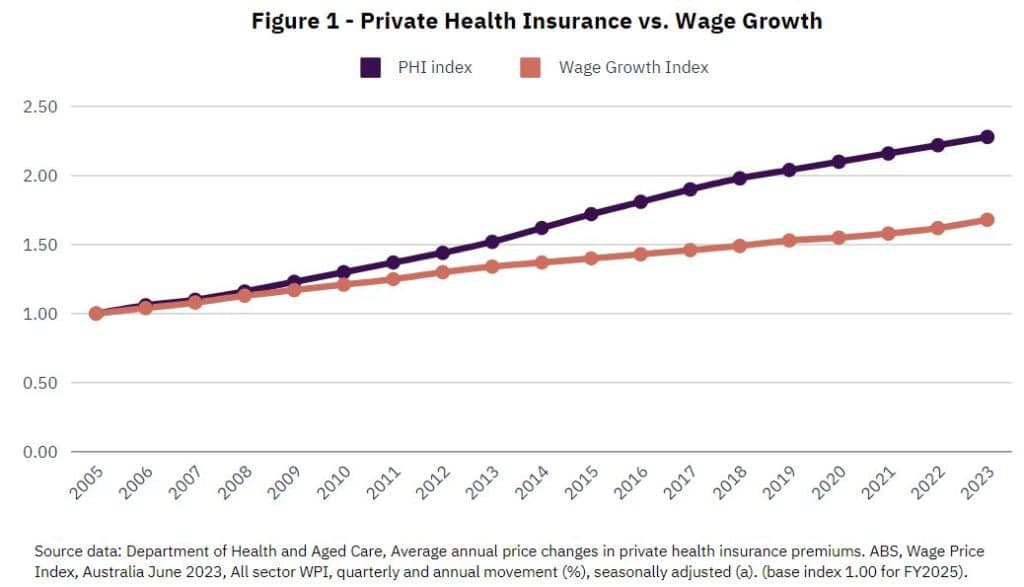

The cost-of-living crisis alongside an ever-widening gap between PHI premium increases and wage growth is becoming alarming for the sustainability of PHI and healthcare. For example, a premium of $2,500 in 2005 now costs $5,698 compared to a wage of $2,500 only growing to $4,013 – leaving a gap of $1,685. The affordability crisis has a threefold impact: 1) Declining PHI membership, 2) Fewer individuals receiving treatment for their condition, and 3) intensified negative effects on vulnerable populations.

A survey by Finder [9] of 1,070 Australians found that 16% of Australians admit they plan to cancel their Health Insurance policy in 2024. Applied to the population, this could be over three million people cancelling their cover – a concerning statistic.

The Grattan Institute paints a challenging picture of Australia’s private health industry, describing it as being in a “death spiral.” They emphasized the urgent need for collaboration between the government and the industry to develop a new plan ensuring sustainability [10]. Premiums for PHI are becoming increasingly unattractive and unaffordable, especially for younger, healthier individuals. As they drop their coverage, the risk pool deteriorates, causing premiums to rise further with additional healthy and younger people dropping out, and the cycle continues. Finder’s survey underscores this trend, revealing that 25% of Gen Z and 19% of Millennials are planning to drop their private health insurance by the end of the year, much higher than the average of 16%, with 58% telling Finder that price was the most important factor.

The aversion to seek health treatments is compounded further for those who do not have PHI. Those without PHI are also more than three times more likely to rarely see a dentist (having only one visit every five years or longer) [11]. Health Savings Accounts can be a useful product to help those without PHI seek appropriate and timely treatments without the fear of the associated costs. With 44.9% of the population only having hospital treatment membership and 54.6% for general treatment membership [12], the time for reform and HSAs is now.

The concern about drop-out is amplified by the potential impacts on vulnerable cohorts in the community. Those without PHI are more likely to experience pain, discomfort, or dissatisfaction with their dental appearance [13]. Finder’s survey also found that more women (18%) than men (14%) plan to cancel their cover.

For Indigenous Australians, only 20 percent in remote areas have PHI, with 72 percent citing affordability as the main barrier to uptake [14]. The SFOC highlighted the importance of timely treatment for vulnerable communities such as Indigenous communities. Indigenous Australians experience 20 times the rate of blindness due to uncorrected refractive error compared to non-Indigenous. In 2016, the treatment rate of refractive error for Indigenous Australians was 11 percent lower than the treatment rate for non-Indigenous Australians [13]. While eye tests are covered by Medicare, the provision of glasses is generally paid for by general treatment cover or out-of-pocket costs.

A worrying trend of no value and exclusions

The reality check of extras

HSAs: A new opportunity

HSAs present an innovative and modern solution to healthcare financing, and variations of HSAs have successfully been implemented in countries all over the world. Domestically, ExtrasJar launched its HSA product in August 2022 and is the only provider of HSAs in Australia, allowing customers to access their investments at the point of sale. ExtrasJar customers can promptly pay for health-related expenses such as dental and optical costs and out-of-pocket expenses with their digital Mastercard®. As the sole HSA provider in Australia offering customers instant access to their funds, ExtrasJar brings a unique perspective on how HSAs can support the health and well-being of Australians. The report, produced by ExtrasJar offers hope for a healthier Australia.

Recommendations

The report offers a series of 13 recommendations that the Australian Government should consider when forming its long-term strategy and policy in relation to healthcare. The recommendations provide a framework on which detailed modelling, impact assessments, and feasibility studies can be conducted. The recommendations include:

1. Clear Objectives of HSAs: HSAs should serve the dual purpose of assisting patients in meeting out-of-pocket healthcare expenses not covered by public and private insurance, as well as facilitating the funding of preventive healthcare treatments and services.

2. Ease of Access: HSA holders should be able to readily access their investments to seamlessly pay for health-related expenses, thus reducing obstacles to utilization and administrative burdens.

3. Voluntary Participation: Participation in HSAs should be voluntary, ensuring individual autonomy in healthcare financing decisions.

4. Tax Incentives are Needed: The Government should leverage Commonwealth tax policy to incentivize HSA adoption. The annual increase in the HSA, net of withdrawal requests and unpermitted HSA expenditure can be administered as an income tax offset benefit in a manner akin to the current approach to work-related expenses.

5. Capped Incentives: To prevent market distortion and manage government expenditure, there should be a limit on the income tax offset for HSAs.

6. Wealth Transfer Limitations: HSAs should not be utilized for intergenerational wealth transfer, preserving their intended purpose as a healthcare financing tool.

7. Administered by Fund Managers: Fund Managers are best placed to administer HSAs, and registered Managed Investment Schemes provide a strong regulatory framework to operationalize HSAs.

8. HSA Statements: HSA providers should issue annual transaction statements to account holders, facilitating the calculation of health-related tax incentives during the annual tax return process.

9. HSA Receipts: Account holders should retain receipts as evidence of health transactions, aligning with standard procedures for tax returns.

10. Investment Earnings: Investment earnings on HSAs should be taxed similarly to the approach taken for investment earnings on Managed Investment Schemes.

11. Distribution and Residual Balances: In the event of an HSA account holder’s death or the closure of the HSA, any residual balance should be disbursed to the designated account holder or beneficiary.

12. HSA and Hospital Excesses: HSAs can be utilized to pay for hospital excesses, providing individuals with an additional means of managing their healthcare expenses.

13. HSA can be used to Promote Health Initiatives: The HSA framework can support government initiatives aimed at promoting preventive healthcare, such as the inclusion of gym memberships.

Conclusion: Government support is needed

The introduction of HSAs in Australia presents a significant opportunity to address the current challenges in our healthcare system. With the support of major industry bodies like the Australian Dental Association and the Australian Medical Association, HSAs could become the third pillar of our healthcare system alongside Medicare and Private Health Insurance.

To ensure their success, 13 recommendations have been outlined in the report. Firstly, HSAs should have clear objectives focusing on assisting patients with out-of-pocket expenses and promoting preventive healthcare. Their implementation should prioritize ease of access, with voluntary participation and tax incentives for driving adoption. Capped incentives will prevent market distortions, while restrictions on intergenerational wealth transfer will maintain their healthcare focus.

Administering HSAs through fund managers and providing regular statements to account holders will ensure transparency and accountability. HSA holders should retain receipts for potential audits, and investment earnings should be taxed similarly to Managed Investment Schemes to prevent market arbitrage. Furthermore, guidelines for residual balance distribution and the use of HSAs to pay hospital excesses are essential considerations.

Additionally, leveraging HSAs for government initiatives promoting preventive healthcare can further enhance their effectiveness. ExtrasJar, having led the way in HSA implementation since 2022, provides invaluable insights for the successful adoption and operation of HSAs.

Australia has the opportunity to transform its healthcare financing landscape, promoting accessibility, affordability, and long-term sustainability. It’s time to embrace innovation and collaboration to build a healthier future for all Australians. By implementing HSAs effectively, we can create a healthcare system that prioritises the wellbeing of its citizens and ensures equitable access to quality care for generations to come.

The information in this article is general in nature as it has been prepared without taking account of your objectives, financial situation or needs. You should consider the relevant Product Disclosure Statement (PDS) & Target Market Determination, and obtain appropriate financial and taxation advice, before making a decision about whether ExtrasJar’s products are right for you.