Having worked as an actuary in general insurance for over 15 years, people ask me if their travel insurance will cover them for COVID-19. But it is always difficult to give a definitive answer. My friends and family are surprised when I respond by saying “it depends” or “let me see the product disclosure statement”; however, insurance is unfortunately not that straightforward. Like you, I wish that it was black and white!

Read the small print

The first thing to note is that each travel insurance policy is different and has various exclusions. I always ask to see the product disclosure statement because, if you are unsure about whether or not you are covered, this is one of the best places to start. You would have been sent this document when you bought your policy. You can also find it on your insurer’s website. Yes, it may be nearly 100 pages long but it is always better to know what your policy covers so that you can have peace of mind when you travel.

Most policies will have exclusions for pandemics

Are you ready for the bad news? Unfortunately, most travel insurance policies will have exclusions for outbreaks of infectious diseases, pandemics, epidemics or “known events” (such as COVID-19) that will lead to claims from those events. If you have just returned to Australia from a trip, or if symptoms are only present in Australia, you will be covered by Medicare. If you have a trip planned, it is also important to remember that, if you cancel just because you are fearful about going or just get cold feet, standard policies don’t usually cover those decisions.

The cut-off date is important

If outbreaks are covered under your policy and you purchased your policy prior to COVID-19 becoming a “known event”, you should be covered for any COVID-19 related expenses overseas. For COVID-19, most insurers have decided that it became a “known event” between the 20th and the 31st January 2020 (when the World Health Organisation confirmed almost 600 cases of the virus across several countries) and have set their own individual cut-off dates between those dates. If you want to know your insurer’s cut-off date, check its website. Travel insurance policies purchased after COVID-19 became a “known event” are unlikely to cover travellers for COVID-19 related expenses overseas.

“Do not travel” warnings can trigger exclusions

You should also monitor all government “do not travel” warnings before deciding to travel. If you intend to travel to any “do not travel” locations, it is likely that an exclusion will be triggered in your policy. It is always worth checking the www.smarttraveller.gov.au website before you go. The plus side is that, if the Australian government issues a “do not travel” advice as a result of a pandemic, your travel insurance may cover your cancellation costs, depending on when your policy was purchased and the general exclusions in your policy relating to pandemic claims.

The “do not travel” advice from the government also applies to life insurance. Although life insurance policies are unlikely to exclude claims related to COVID-19, they do tend to be conditional on you following government travel advice. So be careful!

What could you do in the future?

Historically, pandemics tend to return every 30-50 years so it may be some time before we experience another pandemic like COVID-19; however, with a changing climate, an increasing population and more intensive urbanisation, this time frame may reduce. The 3 key takeaways are as follows:

- Follow any government “do not travel” advice

- Check your product disclosure statement to understand your cover and any exclusions

- Consider a “cancel-for-any-reason” insurance policy if you want full coverage

But be warned! A “cancel-for-any-reason” policy could be an expensive policy and, even with such a policy, you probably still won’t be reimbursed for all of your pandemic related expenses.

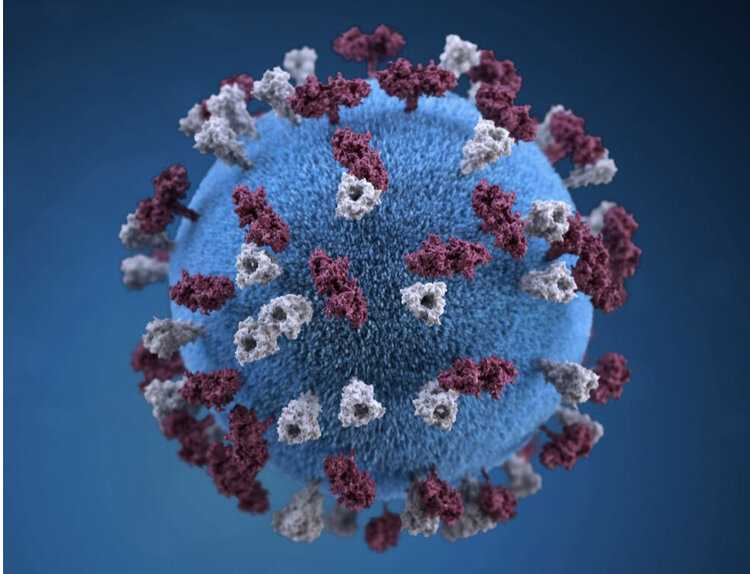

Other than not travelling, one of the best ways to protect yourself from COVID-19 is to wash your hands thoroughly with good old fashioned soap. Why does soap work so well? The short answer is because the virus is a self-assembled nanoparticle in which the weakest link is the lipid (fatty) bilayer. Soap dissolves the fat membrane which leads to the virus falling apart like a house of cards and becoming inactive. Stay healthy!!!