As the health insurance industry struggles to retain customers because of rising insurance premiums, it would seem that some insurers have resorted to questionable conduct to attract new customers.

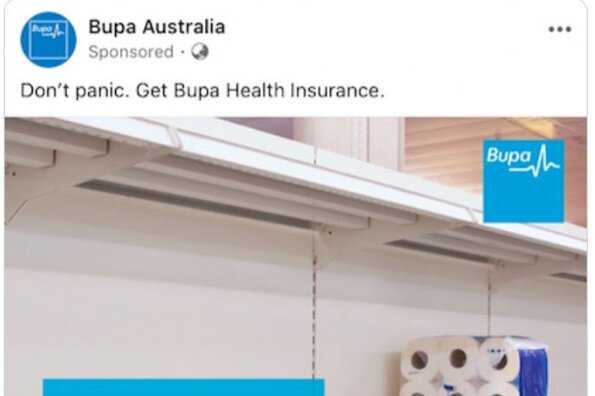

Insurers using toilet paper shortages to get customers?

We have all seen the recent mass panic buying of toilet paper in our supermarkets, despite the detrimental impact that this type of behaviour is likely to have on the elderly and those most vulnerable in our society. Fortunately, most of us are trying to remain calm and not buy into the irrational need to stockpile toilet paper and food supplies in our homes. We would also expect the same from big business; however, it would seem that this is not the case with some private health insurers who are leveraging off the fears and insecurities of Australians in an attempt to increase their customer numbers.

BUPA recently posted a Twitter ad using a photo evidencing the toilet roll shortage with the slogan “because there are other ways to be prepared”.

“Leveraging off the recent toilet roll shortages to increase health insurance sales is questionable”

This ad seems to demonstrate a complete disregard for the anxiety that people are presently feeling about the Coronavirus (COVID-19) pandemic and is only likely to add to their stress. We deserve better and would expect more from a reputable health insurer like BUPA. Thankfully, BUPA has now removed the ad from Twitter but it calls into question the desire of private health insurers for profits over customers’ needs.

Do you need private health insurance for Coronavirus?

Your private health insurance status will not determine if you can be tested or treated for COVID-19. This will be decided by hospitals and medical professionals, not by governments or insurers. In addition, while private health insurance normally allows you to choose your own doctor or a private room in a public hospital, all patients with COVID-19 will be isolated and this could be in a single room or a ward with others. Therefore, it doesn’t make a difference if you have private insurance.

On the medicare government website, it states the following:

- Medicare covers the lab tests for COVID-19. You pay no out-of-pocket costs.

- Medicare covers all medically necessary hospitalisations. This includes if you’re diagnosed with COVID-19 and might otherwise have been discharged from the hospital after an inpatient stay, but instead you need to stay in the hospital under quarantine.

Private health insurers trying to suggest that private health insurance will leave you more prepared for COVID-19 should be called out!

Is my health insurance value for money?

The Australia Prudential Regulatory Authority (APRA) reports that less than half (44%) of the population has hospital cover. 89% of these people are over 30 which could suggest that Australians only have cover to avoid the life time loading. Remember, once you turn 31, a 2% loading is added to your hospital cover premium for every year you’re without hospital cover!!!

“You pay $904 per year on extras premium but only get $438 in benefits. It is time to do the maths!”

Around half (53.3%) of the population have cover for extras and, on average, you only get $438 back a year in benefits. According to finder.com.au, if you live in NSW, you pay $904 a year in premiums meaning that, on average, you lose $466 each year.

We all need to start questioning if this is value for money. Paying $466 a year for someone else to manage your cash flow doesn’t seem logical and the value for money appears to get worse the younger you are. It appears that younger people are subsidising their older cohorts for their general treatments. It is time to redo your maths and start managing your health and wealth. An exciting alternative is coming soon – ExtrasJar!